does ca have estate tax

The federal estate tax despite perennial calls by some political groups for its repeal is still in place although. The federal government though taxes gifts that exceed 15000.

How Does The New Tax Law Affect Your California Estate Plan

Estate taxes though are different than inheritance taxes.

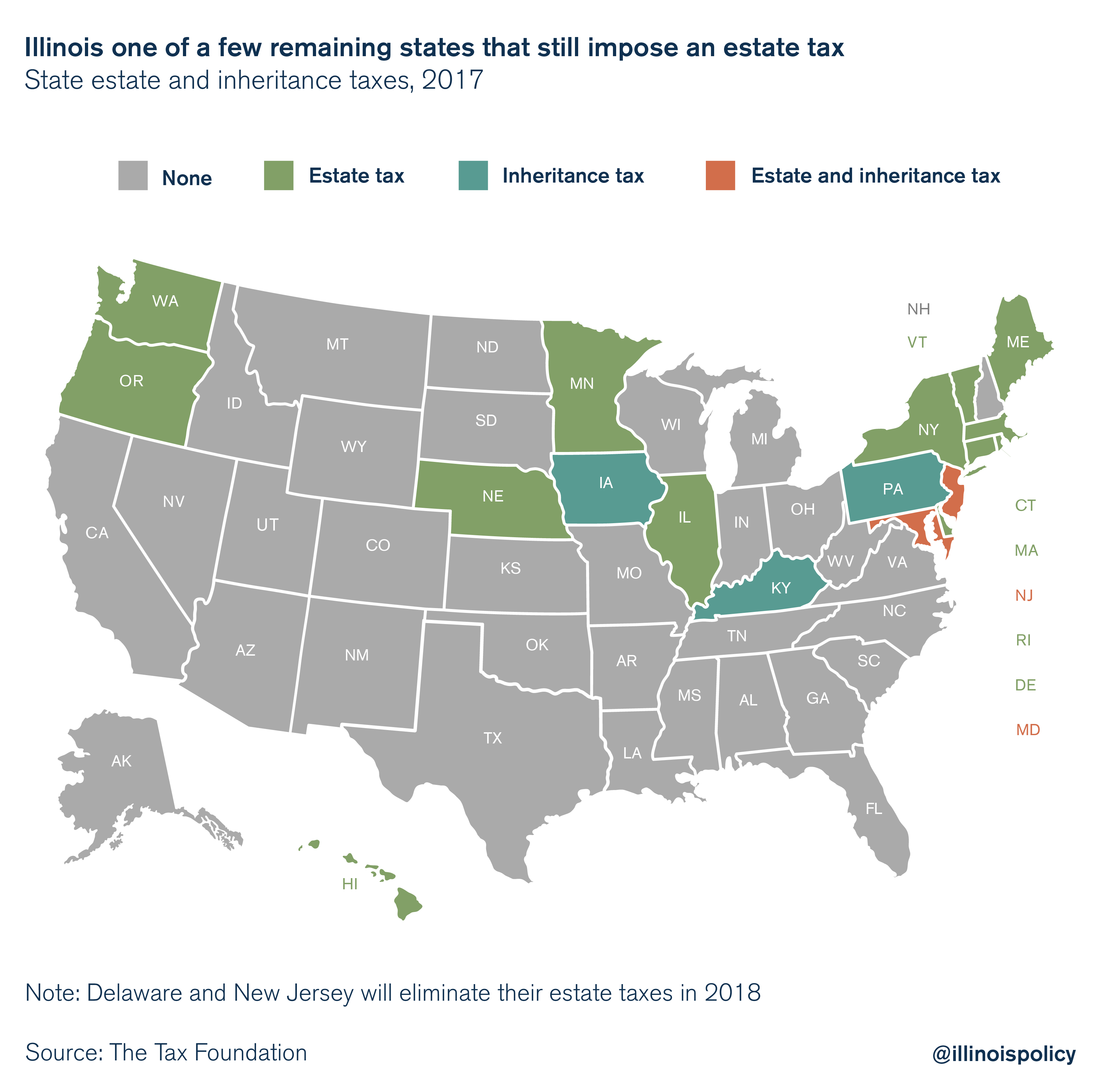

. Web Surprisingly California does not have its own estate tax. Web Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Web There is no estate tax or gift tax in CA.

Web In Canada the CRA does not tax the assets of an estate but they do require that all of the tax owing on income up to the date of death be paid. First some good news. California has no estate tax for individuals who died on or after January 1 2005 and has.

Web There are no inheritance or estate taxes in Canada. Retirement accounts and pension plans are fully taxable though Social Security is. Web Wealthy Californians Are Subject to the Federal Estate Tax.

This is counter intuitive as California is generally a high tax state and many other states have a state level estate. When a person passes away their estate may be taxed. California does not have its own estate tax nor does it have its own gift tax.

Maryland is the only state to impose both. Web California does not have an estate tax or an inheritance tax. Web The portion of the estate thats above this 1292 million limit in 2023 will ostensibly be taxed at the top federal statutory estate tax rate of 40.

Web The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. Web California along with 37 other states dont impose an estate tax no matter how big the estate is. Web The rate threshold is the point at which the marginal estate tax rate goes into effect.

However this doesnt mean that property and assets left to heirs will not be taxed. Web For most individuals in California this is no longer a major concern. Estates generally have the following basic.

California has among the highest taxes in the nation. Web For example California does not have a gift tax. Web An estate is all the property a person owns money car house etc.

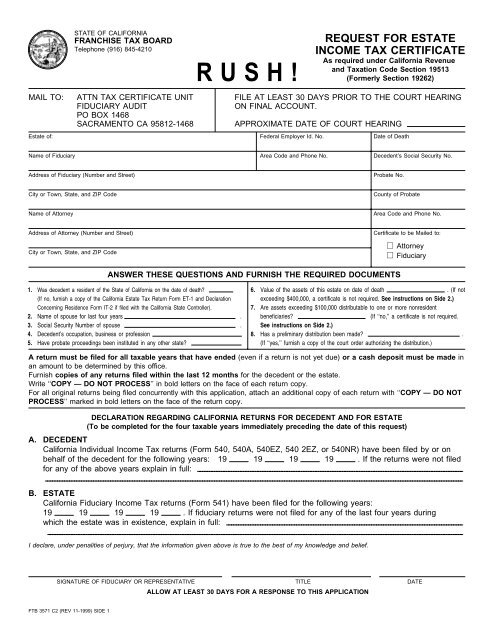

If an estate is worth more than 1206 million dollars for single individuals and 2412 million dollars for married couples. Web A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue. These taxes are applied.

Overall California Tax Picture. You can leave gifts without worry.

California Estate And Gift Tax Planning Forms And Practice Manual

The Death Tax Isn T So Scary For States Tax Policy Center

Death Tax What It Is How It Works Who Qualifies

Is There A California Estate Tax

If I Just Inherited Property Do I Need To Pay An Inheritance Tax Sacramento Estate Planning Attorney

California Tax Trap And Residency For Trusts

California Inheritance Tax And Tax Exemptions Video

California Estate Tax Is Inheritance Taxable Income

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

An Illustrated Guide To The Revocable Trust In California Talbot Law Group P C

Inheritance Tax On House California How Much To Pay And How To Avoid It

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Taxes On Your Inheritance In California Albertson Davidson Llp

California Prop 19 Property Tax Changes Inheritance

There Is No California Inheritance Tax Los Angeles Estate Planning Attorneys

U S Estate Tax For Canadians Manulife Investment Management

1999 Request For Estate Income Tax Certificate California

San Jose Ca Fiduciary Tax Lawyer Santa Clara County Estate Taxes Attorney