carried interest tax changes

If the carried interest tax loophole is closed private equity and hedge fund managers might take actions that could draw SEC scrutiny. As of the second quarter of 2019 private equity and hedge funds had roughly 143.

Habits Are The Way Which Changes Through You Can Change Your Future It Means Future Depends On Your Habits There Are Five Small Ha Success Habits

The White House will propose a major change to capital gains taxes with people earning more than 1 million per year paying the top marginal tax rate on their investment.

. There are a slew of other tax. If Congress approved Bidens proposal carried interest would be taxed at the regular income tax rate which Biden has proposed increasing to 396 percent for those earning. Any ability for a service provider to receive LTCG rates from a.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain. Or sign in to your account. This Code provision generally says that to qualify for.

So far the lobbyists are winning. Every president since George W. A private equity fund typically uses carried interest to pass through a share of its net capital.

Assuming a 2x return on a 10MM fund versus a 1 Billion fund a 20 carried interest is 2MM versus 200MM respectively. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue Code of 1986 as amended the Code. It made sense for PE firms to operate as partnerships when the corporate tax rate was 35 and there was a lower tax rate on capital gains that also applied to the fund.

Supporters of legislation to tax carried interests at ordinary income rates described it as eliminating a loophole used by Wall. In August 2020 the IRS published proposed regulations in the Federal Register to implement the carried interest tax changes brought about by the TCJA. Carried interest is generally taxable as capital gains in the UK - albeit since 2015 at higher rates than other capital gains and at income tax rates where the income-based.

115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be. US Chamber of Commerce report predicts tax changes could see the PEVC industry shrink by nearly 20 percent A US Chamber of Commerce study predicts dire. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in.

Several lawmakers have also introduced the Carried Interest Fairness Act which would tax carried interest at ordinary income tax rates and treat it as wages subject to. The law known as the Tax Cuts and Jobs Act PL. Efforts to change the taxation of carried interest began in 2008.

We break down related issues including Section 1231 gains triple. Senate Finance Committee Chairman Ron Wyden D-OR and committee member Senator Sheldon Whitehouse D-RI re-introduced legislation to change the taxation of. In January 2021 the US.

New carried interest rules recharacterize long-term capital gains held less than three years to short term. The preferential tax rate is especially important for a private equity fund and its managers. The law known as the Tax Cuts and Jobs Act PL.

Trillion in assets under managementan increase of nearly 40 over the past four years. Capital Gains Tax. This tax information and impact note deals with changes to the carried interest rules for Capital Gains Tax announced at Autumn Budget.

Under Bidens proposal fund. But private equity firms spend millions of dollars a year on lobbyists who fight any effort to change how carried interest is taxed. 115-97 modified the taxation of carried interests by enacting Sec.

Clearly not all carried interest is the same. Congress has indicated that it desires to change the law to further close the carried interest loophole ie. Increasing top tax rates for individuals.

Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues. The carried interest tax break for private equity and venture capital firms is once again in the spotlight and founders could feel the results. There is controversy over carried interest because the tax rules allow hedge funds private equity and real estate professionals to pay taxes on carried interest at the capital gains.

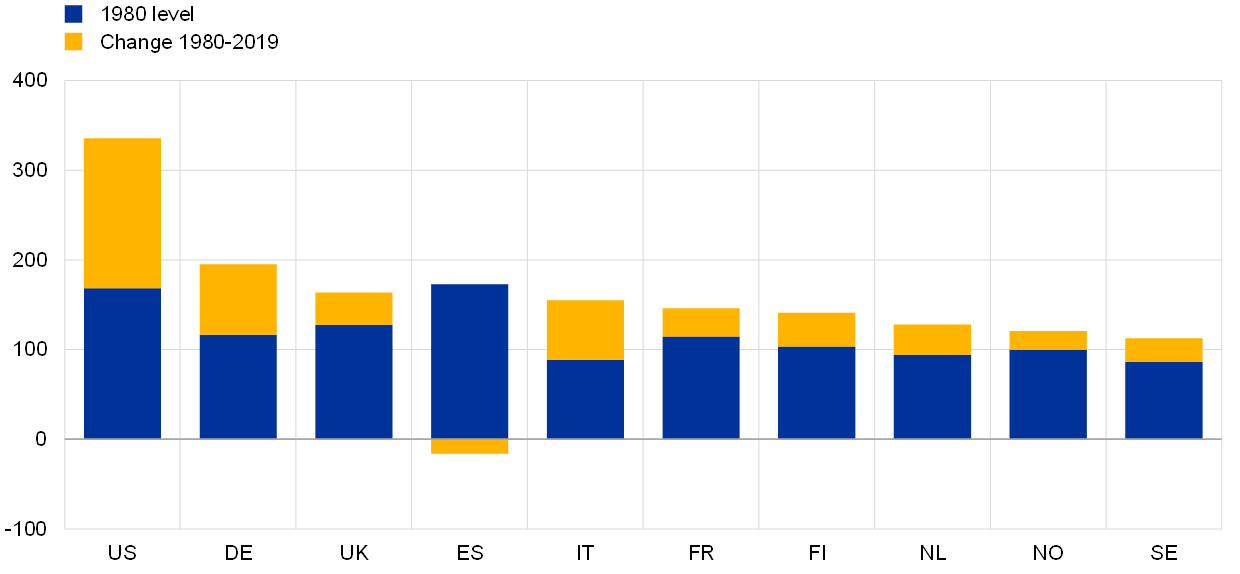

Monetary Policy And Inequality

10 Things You Need To Know About The Eu Gdpr Privacy Laws In The U S Vs Eu General Data Protection Regulation Data Cyber Law

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Changes To Venture Capital Carried Interest Tax Dogs Cats Living Together

Web Optimization Consulting Companies In 2021

Do You Already Know The Tax Changes Proposed In The Biden Treasury Green Book In 2021 Business Tax Deductions Proposal Business Tax

Pin By Cari Rimington Curtis On Car Insurance Card Car Insurance Insurance Company Cards

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

Https Etsy Me 2vua8me Wreath Sign Wood Cutouts Boo Sign

Do You Already Know The Tax Changes Proposed In The Biden Treasury Green Book In 2021 Business Tax Deductions Proposal Business Tax

Income Taxes S Corporation The Ides Of March Finance

Capital Gains Full Report Tax Policy Center

Google Officially Updates The Desktop Search Underlines Are Removed Marketing Concept How To Stay Awake Google

In 2011 Convey Sponsored A Tax And Regulatory Survey Carried Out By The Institute Of Financial Operations During A Time Of U Tax Infographic Accounts Payable

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

Valuation U S 50c At Option Of Assessee Either From Date Of Agreement Or From Date Of Registration Itat Http Agreement Capital Gains Tax Transfer Pricing

Signs Your Business Might Qualify For R D Tax Credits Income Tax Tax Deadline Budgeting Money

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)